2025 Mergers and Acquisitions Overview Report Published (8.1.2026)

The Turkish Competition Authority’s 2025 Mergers and Acquisitions Overview Report has been published. The report, based on data related to the merger, acquisition and privatization decisions taken by the Competition Board in 2025, includes the following main observations:

- The Competition Authority examined a total of 416 merger, acquisition and privatization transactions in 2025.

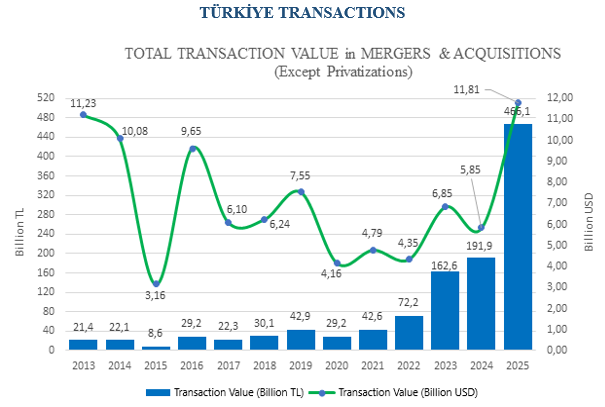

- With the exception of privatizations, in 162 of these transactions the target company was based in Türkiye. The total notified transaction value in the transactions examined was 466 billion 113 million TL (11.81 billion USD). In both Turkish liras and American dollars, this transaction value for 2025 is the highest value on record since 2013, which is when the publication of Mergers and Acquisitions Overview Reports started. The total value for the 19 privatization transactions examined in the same period was around 108 billion 45 million TL (2.74 million USD) Thus, the total predicted transaction value in the 181 transactions involving Türkiye-based companies in 2025 was around 574 billion 159 million TL (14.54 billion USD).

- In 2025, of the mergers and acquisitions where the target company was Türkiye-based, the highest number of transactions, with a total of 25, was in the field of “computer programming, consultancy and related activities,” while the highest transaction value was in the field of “activities of monetary intermediaries”.

- In the same period, 19 privatizations examined were related to the various sub-categories of “generation, transmission and distribution of electric power,” “wholesale of household goods,” and “manufacture of wiring and wiring devices” sectors, and the privatization transaction with the highest value implemented in the “generation, transmission and distribution of electric power,” with around 54 billion 630 million TL. Seven of the privatizations were executed by the Saving Deposits Insurance Fund (Tasarruf Mevduatı Sigorta Fonu).

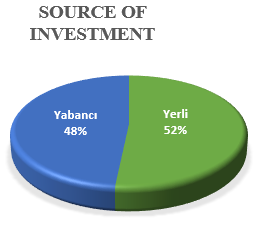

- In 2025, foreign investors envisioned investing in Türkiye-based companies in 55 separate merger and acquisition transactions. Ranking foreign investors according to the number of transactions puts Germany at the top spot with nine transactions, followed by France-based investors with six transactions. In these transactions where the target company was Türkiye-based, the investment value notified by the foreign investors amounted to around 277 billion 462 million TL (7.03 billion USD). This value is the second highest in record since 2013, which is when the publication of the Mergers and Acquisitions Overview Reports started.

- In addition, 219 merger and acquisitions transactions implemented by foreign companies abroad were examined in 2025. The total notified transaction value in the transactions examined was 18 trillion 854 billion TL (477.61 billion USD).

- When the total of 274 transactions implemented by foreigners in Türkiye and abroad are ranked according to economic field of activity based on transaction values, the following sectors stand out globally among those that received investment in 2025:

- Software publishing

- Computer programming, consultancy and related activities

- Motion picture, video and television program activities

- Activities of monetary intermediaries

- Manufacture of basic chemicals, fertilizers and nitrogen compounds, plastics and synthetic rubber in primary forms

- In 2025, the Competition Authority decided on the merger and acquisition transactions notified within an average of 10 days after the final date of notification. Two transactions were taken under final examination in 2025. One of the aforementioned transactions was authorized in line with the commitments submitted by the parties, while the examination process is currently ongoing for the other.